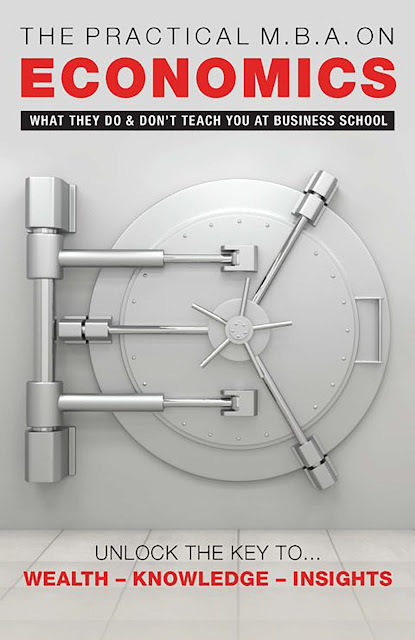

The Practical M.B.A on Economics by Joseph Gulesserian

One of my majors in college is Economics so when I saw this book come up for tour I jumped at the chance. I know economics is not the most thrilling topic for most people but it is a very important topic to understand. This book is not a quick read at 527 pages but if you want to read about economic events in everyday terms, it is worth the read. This book includes examples from as recent as May 2022, so it is very relevant. The author covers general topics as well as specific events such as the Great Depression and the Great Recession. It is broken into clear sections so if you are not interested in a topic, you can easily skip to what does interest you. Keep reading for the book description and don’t let the length of the book scare you away. It is a very interesting book. The author does express his personal opinions on some topics but there is enough information that you can form your own opinion as well.

Stay tuned for a giveaway at the bottom of the post!

Author Interview with Joseph Gulesserian, author of The Practical M.B.A. on Economics "What They Do & Don’t Teach You At Business School"

What is the difference between CPI inflation and effective inflation?

The Consumer Price Index (CPI) does not reflect essential purchasing on the things we buy and need the most. For example, the basket of goods in the CPI are weighted towards cell phones, ISP and Cable providers, electronics, house rent, clothes. However, the index gives little weight to grocery basket items such as cereals, vegetables, fruits, energy and house price inflation. For example, if let’s say, gasoline suffers from price escalation volatility, they either reduce the weight within the index or kick it out of the CPI.

The official narrative of CPI inflation is 9.1% inflation, and if we used the same measurement as in the 1980’s of inflation, when Volcker was Fed chairman, the real effective inflation is closer to 20%. Effective inflation is captured by a site called shadow stats that concurs with that it is closer to 20%, which you can feel when going to buy gas and groceries.

Who Caused the Inflation?

Put simply, the cause is reckless spending by government, facilitated by Central Bank money printing that equates to lending money to buy 10-year Treasury Bills from an insolvent government.

The official inflation narrative was the clogged ports that lead to logistical issues, then the story changed to transitory inflation (temporary), then terms like peak inflation, and now the Russia-Ukraine conflict, where CPI inflation was already at 7% before the war. Now the new narrative is greedy oil companies. All these are prevarications by the presstitute MSM who act as one with government to deflect the truth

The true cause is the “Cantillon effect”, where too much money is chasing the same amount of goods along with low monetary policy (interest rates), causing inflation. The genesis lies in all the helicopter money sent during the pandemic, where people stayed home, (unlike Sweden who did not lockdown their economy and fared better than most of Europe in health), ordered products on Amazon, who in turn ordered them from China, the world’s workshop, ending up clogging the ports, creating price escalations on commodities and steamships.

This is discussed in detail in my book.

What is the true cost of inflation?

It is tax on the consumer, for example, if your monthly expenditures on your home basket of goods is $2,000 per month and inflation is effectively 15%, you are in effect paying a tax on the same amount of goods of $300.00 per month. So, government benefits, since let’s say, sales tax is 7%, they collect on the higher inflated amount. Put this number in an economy of $20 trillion that grows to $23 trillion, and that means government collects an extra $210 billion. Even if wages go up from $50,000 to $60,000, federal and state income tax at 25% equates to an extra $2,500 of taxes. At the same time, by earning $60,000, it might bump you into a 30% income bracket with a net increase on taxes of $7,500. Hence, the raise you received has net benefit of $2,500, which puts one well behind the inflation curve.

The other cost is the wealth divide, where people with no assets cannot keep up with appreciating assets. Again, this is monetary in nature, meaning money printing and artificially low interest rates, and it hits the working poor and the middle class the most.

What is the definition of a recession?

The classical definition of a recession is 2 quarters of the GDP shrinking, meaning the economy is shrinking.

A recession is a natural bi-product of the free markets where inefficiencies and distortions in the economy are rinsed out allowing the markets to go into a more natural supply and demand price equilibrium. Meaning stocks, homes and products fall into more affordable pricing. Because it is not politically expedient, government and Central Banks move in with both fiscal and monetary interference that inhibit a natural recovery, and in essence, end up leaving more permanent distortions in the economy and ensuring that the next recession will be even more pronounced.

The outcome is that government leaves a mountain of public debt, price

and technology distortion and higher taxes to suffocate the consumer and firms.

What are paper currencies backed with?

Fiat currency interchangeably called paper currency is not hard backed except by the trust of the government that issues it. After Bretton Woods in 1944, the U.S. dollar and other major currencies, such as the Pound Sterling, were backed with gold. Hence, for every dollar issued, it would be backed with 40% gold, making it a hard backed currency. Meaning that Central Banks could not issue money without a gold reserve.

This changed in 1971, as President Nixon took the USD off the gold

standard, which is discussed in my book. What this means is that Central Banks can

issue in theory infinite currency without the hard backing of gold.

Subsequently, governments can spend without accountability, and this leads to

debasement of money and inflation, where it takes more dollars to buy the same

amount of goods.

Joseph Gulesserian is an entrepreneur and a published author, who wrote “Newspaper Boys Always Deliver”, a story of pop culture and technology. He has built and brought to market health and beauty Brands with global reach that has sent him around much of the world.

With his technical training, he has spent time on the factory floor with technologies from machine building to software information systems, for competitive advantage.

He has an insatiable eclectic curiosity for flirting with the outer parameters of the human imagination, is a student of history, loves the arts, design, the digital age, math, while believing in the tenets of the marketplace of ideas and personal liberty.

After earning his MBA from Edinburgh Business School in the U.K., he taught Corporate Finance, Capital Markets, Statistics and marketing, as an adjunct professor at Toronto colleges.

connect with the author: website ~ facebook ~ twitter ~ instagram ~ linkedin

THE PRACTICAL MBA: ECONOMICS Book Tour Giveaway

Dear Sheri, I want to sincerely thank you for your kind review on the Practical MBA on Economics and glad you found the book interesting.

ReplyDeleteThe only point I want to make is that there are some sections that take us up to May 2022 (included the Wars effects on Monetary hegemony) and if you could mention something to this effect I would be grateful. I remember when editing working in this stuff as late as May 2022 with the break-necking events going on I kept adding some recent things.

Again, thank you so much for the review and stay well.

Kind regards,

Joe Gulesserian